Webinar: What Will Covid-19 Mean for Process Modernization in Insurance Today…And Tomorrow

Case Study: Digital Transformation of a Leading Life Insurance Company

Video: Automation of multiple insurance processes at Tokio Marine HCC

Webinar: What Will Covid-19 Mean for Process Modernization in Insurance Today…And Tomorrow

Case Study: Digital Transformation of a Leading Life Insurance Company

Video: Automation of multiple insurance processes at Tokio Marine HCC

Insurance Underwriting

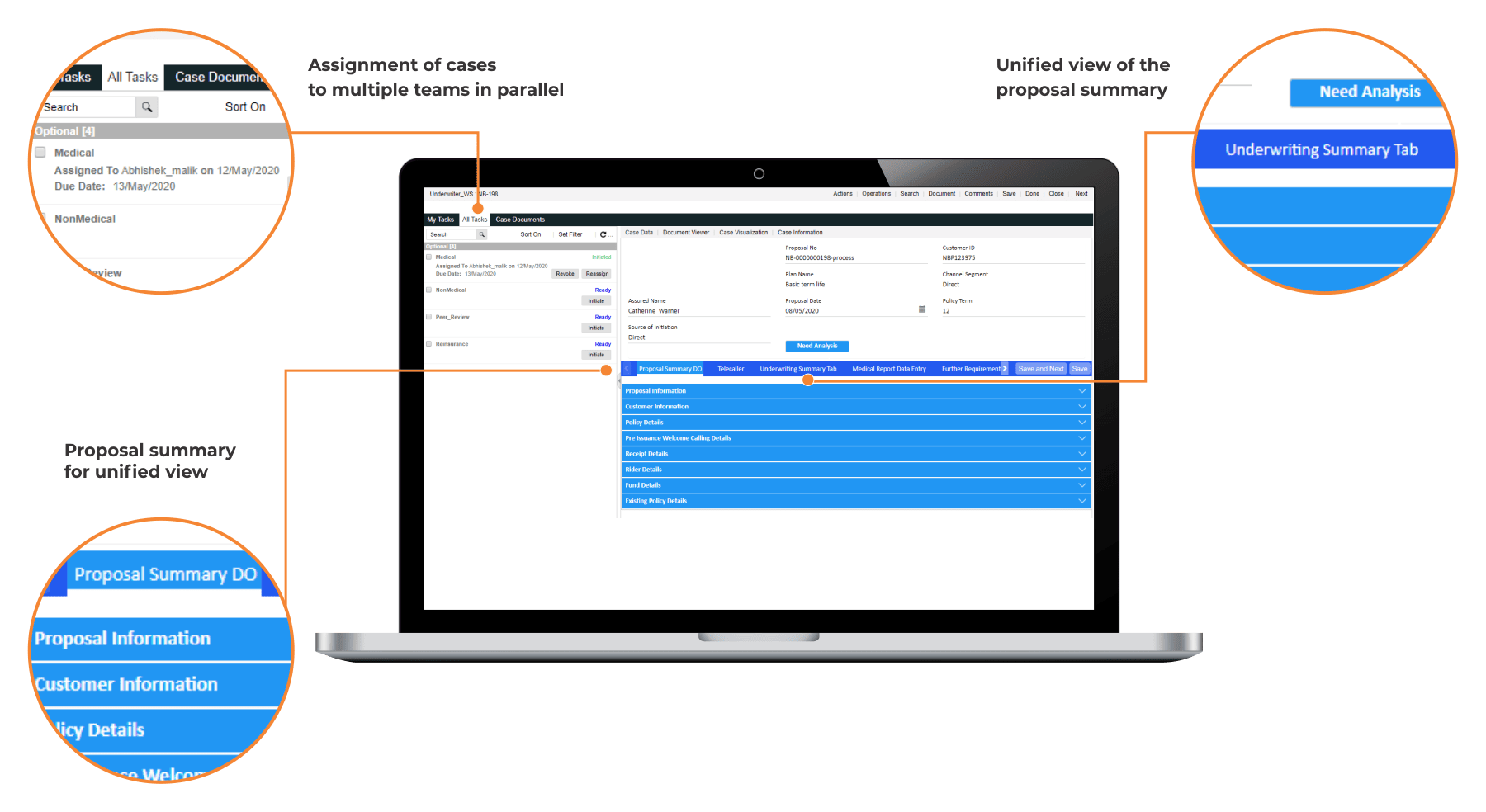

Eliminate manual intervention and ensure zero underwriting errors with the auto underwriting rule engine. Meet regulatory requirements and adapt to dynamic business needs with our configurable solution. Automate end-to-end policy issuance process, deliver superior user experience, and ensure a shorter prospect to customer lifecycle.

Policy Elements and Underwriting Analysis

- Configurable user interface to define data elements per specific requirements

- Sophisticated dashboards for in-depth data analysis and report generation

Underwriting Checks and Validations

- Verification and validation, including duplicity checks, anti-money laundering, fraud, blacklisting, etc.

- 360-degree visibility to reduce risk

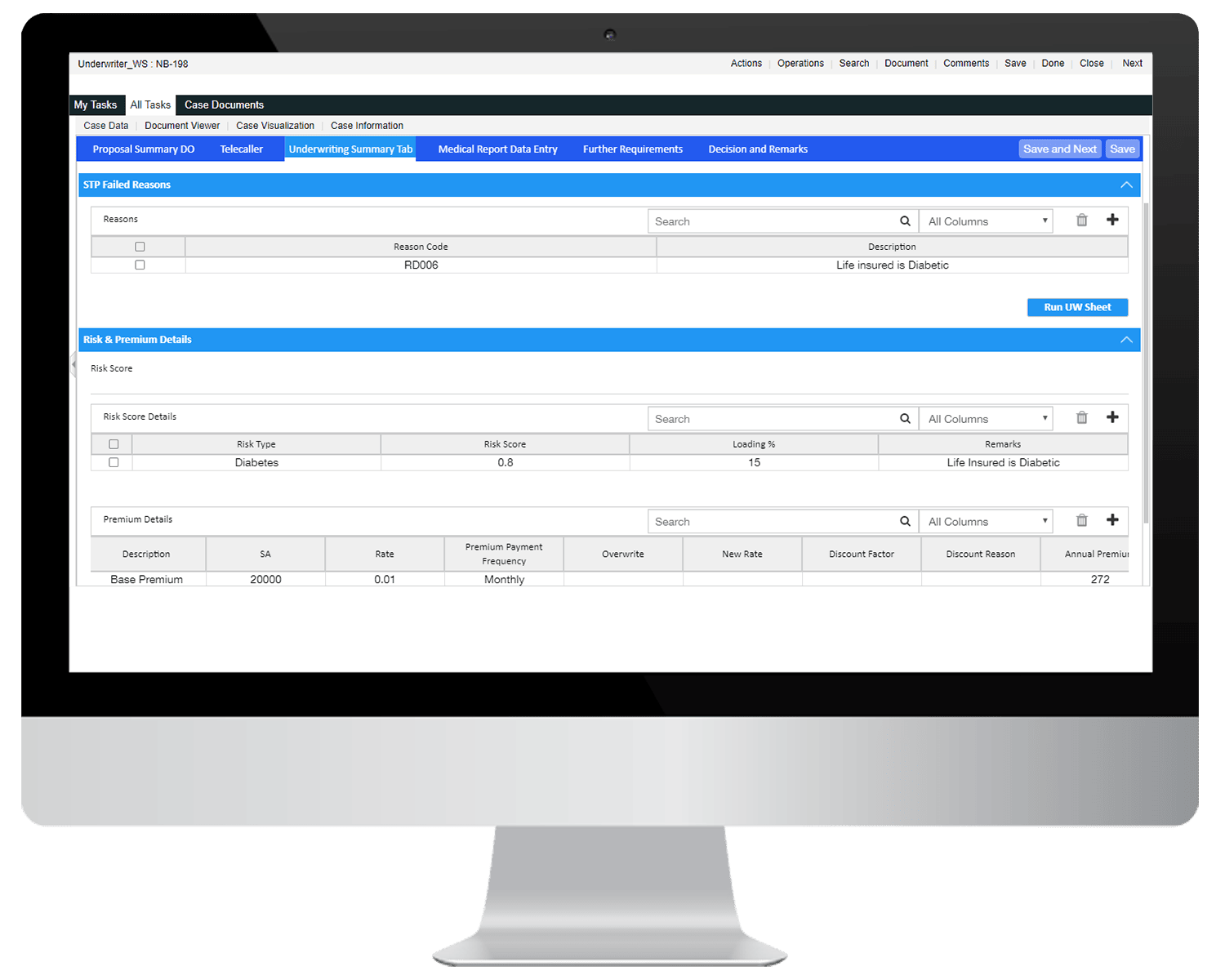

Core Underwriting Engine

- Dynamic rules to facilitate straight-through processing of low complexity submissions and automate key underwriting tasks

- Abstract underwriting rules and complex logic are configured into the system

- Flexibility to change rules according to dynamic business requirements

Underwriting Evaluation

- Automatic policy evaluation to maximize the percentage of straight-through pass cases for quick policy issuance

- Auto-classification of non-straight-through cases and routing of cases to underwriters based on the authority limit

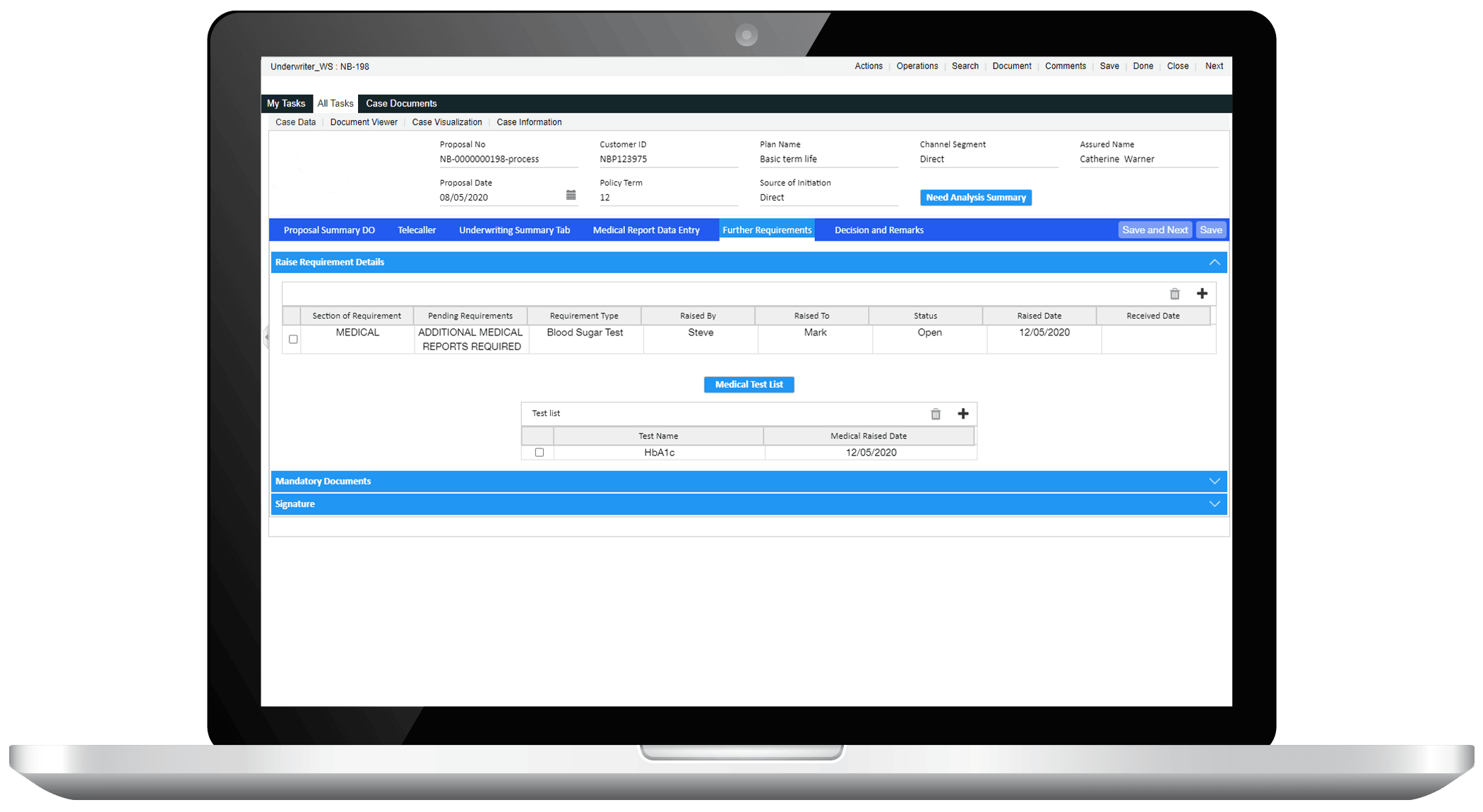

Additional Information Capture

- Access to comprehensive case details to ensure informed decision-making

- Request capabilities for additional documents and information, based on medical or non-medical parameters

Integration and Personalization Capabilities

- Seamless integration with third-party and legacy applications, such as policy administration, CRM, etc.

- Omnichannel, personalized engagement across all channels, including mobile, web, in-person, chatbox, social, and bots

SOLUTIONS FOR INSURANCE FIRMS

Accelerated digital transformation of processes

Watch how Venerable leveraged Inviqa’s platform to accelerate digital transformation for enterprise-wide processes.

Digital Health

in the Pandemic World

Hear Alok Rungta, Head of Health and Protection, AXA Insurance, as he speaks on the post-pandemic customer behavior

Accelerated digital transformation of processes

Learn how Tokio Marine HCC modernized their policy generation process with Inviqa.

FREQUENTLY ASKED QUESTIONS

Inviqa’s rule-based processing auto-classifies the cases into straight-through and non-straight through based on the authority limit. Straight-through cases go directly for policy issuance, and the policy kit is automatically sent to the customer.

Inviqa’s solution provides seamless integration with third-party and legacy applications, such as policy administration, CRM, etc., and with external databases for AML, fraud checks, credit bureaus, and other essential background checks. Inviqa’s solution can also be integrated with existing digital assets like mobile apps, web portals, chatbots, etc.

Any changes that need to be made in the workflow, form, approval hierarchy, etc. can be implemented by the business users themselves with the help of Inviqa’s low code platform, where minimal coding is required, and any modifications to be performed in the solution can be done by simple drag and drop capability.

The solution comes with a Business Activity Monitoring Tool, which provides functional, operational, or investigative reports. These reports can be bar charts, pie charts, or tabular reports and are displayed on dashboards. These are drill-down reports that provide critical information about the performance, work item completion rate, bottlenecks, etc. Also, multiple filters can be created for different reports to create ad-hoc reports based on date, month, year, branch, line of business, etc.

Inviqa’s solution can automatically generate documents like acknowledgment slips, policy schedules, quotation letters, etc., from the data keyed into the system. These documents are accessible on the same screen as the policy underwriting solution, thus reducing the task of switching between the windows. The generated documents can be automatically sent out to the customers via email.