Case Study: Trade Finance process transformation for one of the most tech-savvy banks in the world

Case Study: Sprucing up Trade Finance process for a leading Indian Bank

Whitepaper: Holistic Transformation in Trade Finance

Case Study: Trade Finance process transformation for one of the most tech-savvy banks in the world

Case Study: Sprucing up Trade Finance process for a leading Indian Bank

Whitepaper: Holistic Transformation in Trade Finance

Trade Finance Automation Software

Automate and centralize standard trade finance processes, including export and import-related documentation, negotiation, quotation, and remittances. Ensure adherence to SLAs and regulatory requirements by implementing checklists, efficient tracking of credit documents, and internal controls. Furthermore, increase the scale of operations by extending trade finance services to even low-volume branches.

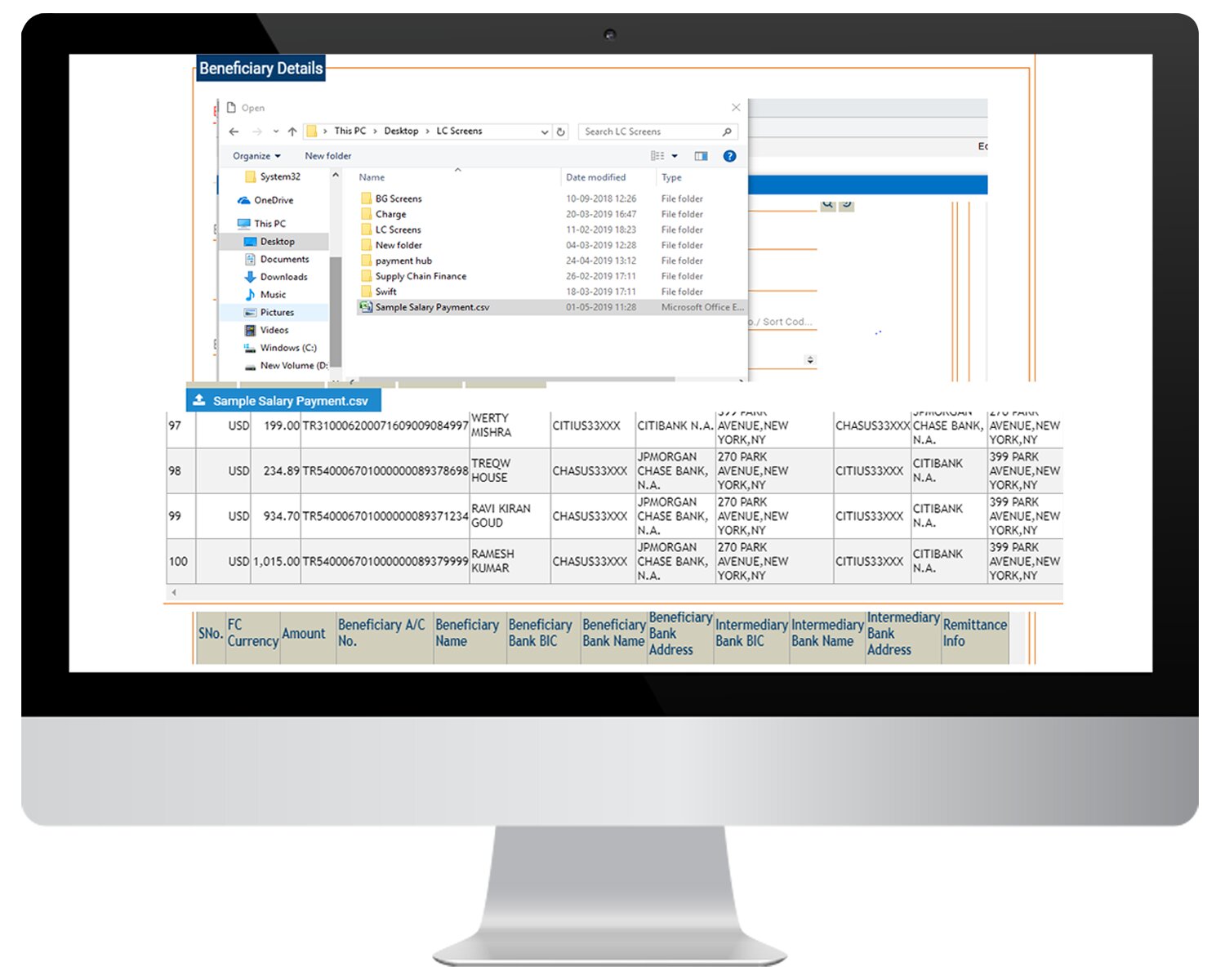

Multi-channel Trade Process Initiation

- Multi-channel transaction initiation via web portal, handheld device, or branch walk-in

- Automatic retrieval and population of customer details from core banking system

Straight-through Processing

- Elimination of manual case reviews with an automated rules engine

- Direct posting of transactions into the core banking system

Loan Limit Availability Check

- Limit availability checking to fetch and earmark limits, and push the limit utilization data for each transaction

- Instant access to loan account numbers and repayment schedules

Streamlined Online Operations

- Centralized trade operations with online trade finance processing at a central hub

- Improved liquidity with the release of cash otherwise stuck in a complex supply chain

Cost Reduction and Scalability

- Centralized trade operations with online trade finance processing at a central hub.

- Improved liquidity with the release of cash otherwise stuck in a complex supply chain.

Trade Process Monitoring and Reporting

- Business activity monitoring to track loan requests, processes, and resource utilization, as well as to generate reports and user-specific dashboards.

- Master data management module to manage various masters.

SUCCESS STORIES

Seamless Integration with Fintech Partners

Watch this video to understand how Advia Credit Union is leveraging Inviqa to seamlessly integrate with fintech partners and transform member experience.

Enhancing Account

Opening process

Learn how Georgia's Own Credit Union leverages Inviqa Account Origination Platform to minimize time taken to open an account, and easily integrate with third party systems.

Why Inviqa is the

Partner of Choice

Watch this video to learn why Inviqa is the partner of choice for Old Point National Bank.

Credit offers in

less than 1 minute

Qander Consumer Finance leverages Inviqa automation platform to transform and automate their banking processes, delivering credit offers to customers in under a minute.

50%

reduction in cost

Nancy foster, SVP and Credit Administrator, talks about using Inviqa solutiona to digitally transform BNB Bank's banking processes for improved customer experience.

Turnaround time reduced from day to an hour

Qander Consumer Finance leverages Inviqa automation platform to transform and automate their banking processes, delivering credit offers to customers in under a minute.

Accelerating digital across 20 branches

Learn how Wilson Bank & Trust is leveraging Inviqa Digital Transformation Platform for online account opening, business banking, and small business lending.

FREQUENTLY ASKED QUESTIONS

Inviqa software provides a complete unified solution for Trade Finance which includes end-to-end trade finance processing, supply chain finance, payments hub, and compliance.

The various products included in Inviqa’s Trade Finance solution are: Letter of credit | Standby letter of credit | Bank guarantee | Bills under the letter of credit | Bill under collection | Outward remittance| Inward remittance | Import and export financing and more.

Yes, Inviqa offers OCR technology for auto-updating of fields on the forms. Apart from the OCR technology, Inviqa also offers classifying, extracting, and validation of documents using AI / ML-based models for identifying and populating discrepancies in line with UCP / ISBP / URC, etc.

Yes, Inviqa offers a customer web portal that is interactive and supports two-way communication. All transactions between the bank and the customer can be initiated through the web portal.

Yes, Inviqa offers digitization of documents, as part of the automation process of its Trade Finance Solution. Inviqa’s Trade Finance Solution is tightly coupled with a document management system where documents are digitized as well as archived.

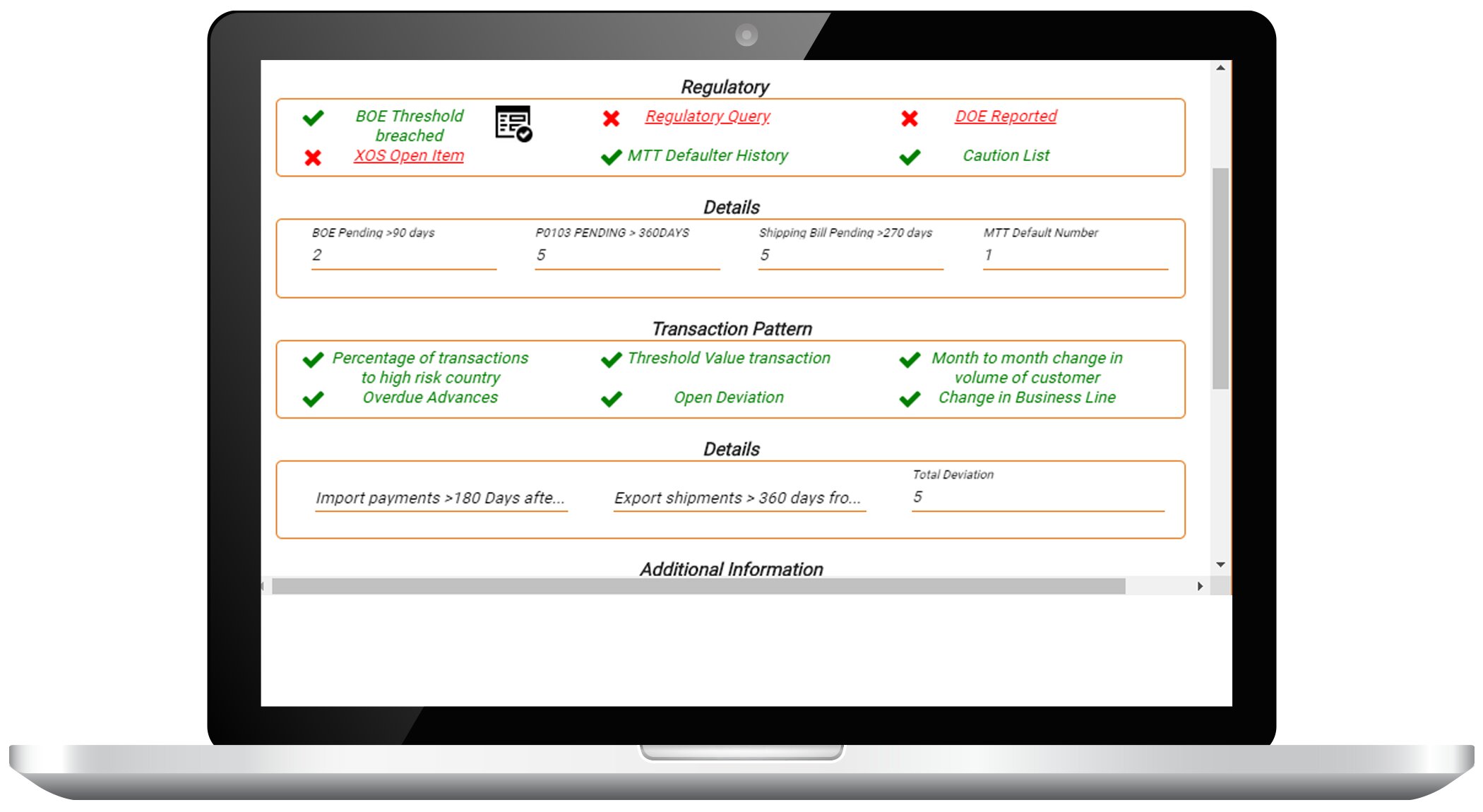

Yes, Inviqa’s Trade Finance solution has built-in international compliances which come with the solution as out of the box. However, concerning sanction screening, the Inviqa trade finance solution will integrate with the existing screening system of the bank via integration adaptors. APIs for integration will be shared by the bank at the time of gap analysis.

Yes, the solution can process end-to-end payments including cross-border and local payments. Inviqa product is also SWIFT, and GPI compliant and supports ISO 20022 compliances as well.

Yes, end-to-end processing of supply chain finance is supported. The products under the module include marketplace, pre-shipment finance, post-shipment finance, factoring, reverse factoring, Forfeiting, and more.