eBook: Implementing a Lending Solution

eBook: Selecting The Right Commercial Lending Software

Whitepaper: The ROI Myopia in Commercial Lending

eBook: Implementing a Lending Solution

eBook: Selecting The Right Commercial Lending Software

Whitepaper: The ROI Myopia in Commercial Lending

Inviqa Digital Loan Origination System

Enable your enterprise with the flexibility and adaptability to stay future-ready by implementing loan origination solutions, built on our low code digital automation platform. Leverage scalable lending solutions to cater to all kinds of loans, including retail, SME, commercial, and SBA loans. Furthermore, ensure compliance with regulatory requirements and streamline your lending processes by bridging operational silos and unifying your front and back offices.

EBOOK

5 Symptoms That Your Loan Origination Is Slowing You Down!

Download the eBook to gain insights into the 5 symptoms that your loan origination is slowing you down. Also, learn how you can overcome the issues that hinder your lending performance and transform the process.

Download

Consumer/Retail Lending

- Digitized lending processes

- Multi-channel loan application

- Lending risk management

- Configurable rules and templates

- Lending audits and reporting

- Integration with third-party systems

Commercial Lending

- Provisions for All Loan Types

- Portfolio Monitoring and Analysis

- Intelligent Underwriting and Risk Rating

- Management of Leads and Customer Relationships

- Integrated Loan Closing

- Rapid Loan Origination and Renewal

- 360-degree Visibility

Small Business Lending

- Multi-channel document submission

- Zero-touch processing and efficient lead generation

- Back office review workspace

- Credit analysis and monitoring

- Seamless integration

SBA Lending

- SBA loan application management

- Digitized work environment

- Loan document checklist and alerts

- Online customer loan portal

- Unified loan processes

- Configurable rules-based processing

SME Lending

- Intelligent credit decisioning

- SME lending rules and templates

- Holistic view of SME loan accounts

- Seamless customer experience

- Intelligent loan underwriting

- SME lending compliance and risk management

Mortgage Lending

- User-friendly self-service portal

- Pre-screening and credit analysis

- Document management and eSignature support

- Intelligent and responsive activity monitoring

- Integrated operations

NBFC Lending

- Digitized lending processes

- Loan Origination

- Loan Management

- Loan Collection

- personal, small business, auto, home, and mortgage

Student Loan Management

- Student Onboarding

- Loan Underwriting and Tracking

- Payment Services and Closure

- Account Maintenance and Reporting

- Collections Management

SOLUTIONS FOR FINANCIAL INSTITUTIONS

SUCCESS STORIES

Seamless Integration with Fintech Partners

Watch this video to understand how Advia Credit Union is leveraging Inviqa to seamlessly integrate with fintech partners and transform member experience.

Enhancing Account

Opening process

Learn how Georgia's Own Credit Union leverages Inviqa Account Origination Platform to minimize time taken to open an account, and easily integrate with third party systems.

Why Inviqa is the

Partner of Choice

Watch this video to learn why Inviqa is the partner of choice for Old Point National Bank.

Credit offers in

less than 1 minute

Qander Consumer Finance leverages Inviqa automation platform to transform and automate their banking processes, delivering credit offers to customers in under a minute.

50%

reduction in cost

Nancy foster, SVP and Credit Administrator, talks about using Inviqa solutiona to digitally transform BNB Bank's banking processes for improved customer experience.

Turnaround time reduced from day to an hour

Qander Consumer Finance leverages Inviqa automation platform to transform and automate their banking processes, delivering credit offers to customers in under a minute.

Accelerating digital across 20 branches

Learn how Wilson Bank & Trust is leveraging Inviqa Digital Transformation Platform for online account opening, business banking, and small business lending.

WHERE ARE YOU IN YOUR DIGITAL TRANSFORMATION JOURNEY?

We have compiled tools and documents to help you in your journey. Knowing that “what you see depends on where you stand,” we have something for you, as a line-of-business operations in-charge, an IT leader, or a C-level executive, for your industry-specific needs.

Learn More

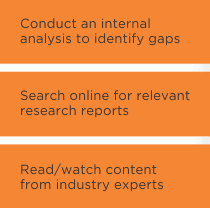

At this stage, you might find that the available technology/solution is going beyond your initial expectations in terms of scope. This is also the stage of building consensus among your peers for your industry-specific needs, whether you are a line-of-business operations in-charge, an IT leader, or a C-level executive.

Learn More

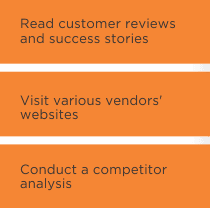

This stage is all about looking beyond features and functions. After all, addressing just the immediate need can translate into “short term gain but long-term loss.” Invest in a technology that solves for your today’s needs and is extensible and configurable for your unknown future needs. As a line-of-business operations in-charge, an IT leader, or a C-level executive, you don’t want to go through the same process in another 2-3 years !

Learn More

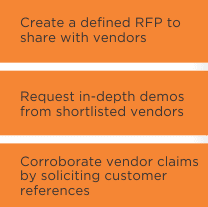

It all comes down to choosing the right partner. Their innovation history, industry focus, local presence, support services, partner ecosystem, technology strength, cost effectiveness, customer references, risk rating, and lot more needs to be evaluated. As a line-of-business operations in-charge, an IT leader, or a C-level executive, you are all evaluating them from your unique perspectives!

Learn More

That feeling of achievement and relief after a successful, on-time, in-budget project is all what you look for. Believe us, the feeling is mutual. As a line-of-business operations in-charge, an IT leader, or a C-level executive, make sure you celebrate the milestone, recognize everyone who made the project successful, and identify your additional digital needs.

Learn MoreFREQUENTLY ASKED QUESTIONS

Inviqa’s loan origination software offers a queue-based workflow approach for initiating and completing the application or performing relevant tasks and activities. Each user within the process can have access to their queue. They can log in and see only work items assigned to them, or all users of the same department can view the work items in a queue based on the bank’s requirements. The queues are rights-based, allowing only an authorized user to view and access them. Further, filters may be applied so that only certain users see specific items in a queue (e.g., loan requests under $1 million). Each application moves from one user to the next within the process flow. As soon as one user completes an application, it goes into the queue of the next user/department as defined within the application workflow.

Inviqa’s Loan Origination System includes dashboards or reports that monitor key performance indicators such as loan cycle time, performance (time) relative to expectations, and office production forecasts.

The solution has a built-in business activity monitoring tool with in-built productivity and process metrics. These reports can be functional, operational, or investigative. While Inviqa will configure a set of reports for the bank during the implementation cycle, any new report can be easily configured in the solution using the report designer wizard. No programming effort is required to create these reports.

Reports can be in the form of bar charts, pie charts, or tabular reports and are displayed on dashboards. These are drill-down reports that provide critical information about the performance, work item completion rate, bottlenecks, etc. Also, multiple filters can be created for different reports to create ad-hoc reports based on date, month, year, branch, line of business, etc.

The solution leverages the underlying low code process automation framework (BPM) to automate the loan origination workflow. It supports loan value-based approval, parallel (committee-like), and sequential (chain-like) routing of the loan request to the appropriate lending/credit authorities.

The routing and distribution of loan requests can be done manually or automatically based on business parameters such as loan value, customer relationship, total exposure, risk rating, etc.

An approval matrix/lender tree will be configured in the master data management of the proposed solution as per the bank’s requirements.

During the entire process, the solution maintains a detailed audit log that records all actions, changes, etc., made by the bank’s user, along with the username and date/time stamp.

Yes, the Inviqa LOS provides a customer portal for the online initiation/application of a new loan request. The online initiation is an extension of the financial institution’s website and is tightly integrated with the underlying LOS platform. The online initiation is configured as per the branding guidelines of the financial institution.

Inviqa LOS solution allows for auto-decisioning/straight-through processing of loan requests that are based on meeting the parameters/checklists defined by the bank. By leveraging the underlying low code process automation platform, requests for credit/loans can be routed through different workflows based on the request type, loan amount requested, entities, etc. For example, there could be a “no-touch,” “low-touch,” or “high-touch” type of approach to requests. If all the bank’s defined parameters are met, a loan can be completely approved and booked with no manual intervention, or if certain criteria are not met, then the loan will be routed to the required queue for processing.

Inviqa’s loan origination software integrates with Topaz Systems, LexisNexis, IMMeSign, Experian, Wolters Kluwer, Compliance Systems, CoreLogic, RIMS.

Typically, Inviqa has seen that once a consumer account is opened, the new customer is onboarded into the core. If the bank views onboarding activities as a separate process/requirement different from this, Inviqa would need a more detailed understanding of the bank’s consumer onboarding process. Inviqa will work with the bank during the implementation process to align the solution to the bank’s specific requirements regarding consumer onboarding.

Inviqa’s account opening and loan origination solutions are available on the cloud and on-premise.

Personal loans, Credit cards, Direct auto loans, Shared loans, Secured loans, Unsecured loans, Personal line of credit, Overdraft line of credit, Retail loans, Small business loans, Commercial loans.

Yes, Inviqa integrates with different credit bureaus such as Experian, Equifax, etc. It allows for different models to be used by product origin.