Whitepaper: 7 Imperatives for Transforming Online Account Opening

Whitepaper: Selecting Your Online Account Opening Platform

Whitepaper: The ROI Myopia in Online Account Opening

Whitepaper: 7 Imperatives for Transforming Online Account Opening

Whitepaper: Selecting Your Online Account Opening Platform

Whitepaper: The ROI Myopia in Online Account Opening

Online Account Opening Software

Accelerate customer acquisition, optimize costs, reduce abandonment rates, and deliver a superior customer experience with the help of a scalable and user-friendly online account opening software. Intuitively guide customers through the process with a portal-based solution, built on a low code digital automation platform. Ensure that your account opening interface is intelligent and responsive, allowing customers to initiate, pause, and complete their application across any mix of channels without losing their data. Additionally, empower your employees to upsell and cross-sell products based on customers’ dynamic needs.

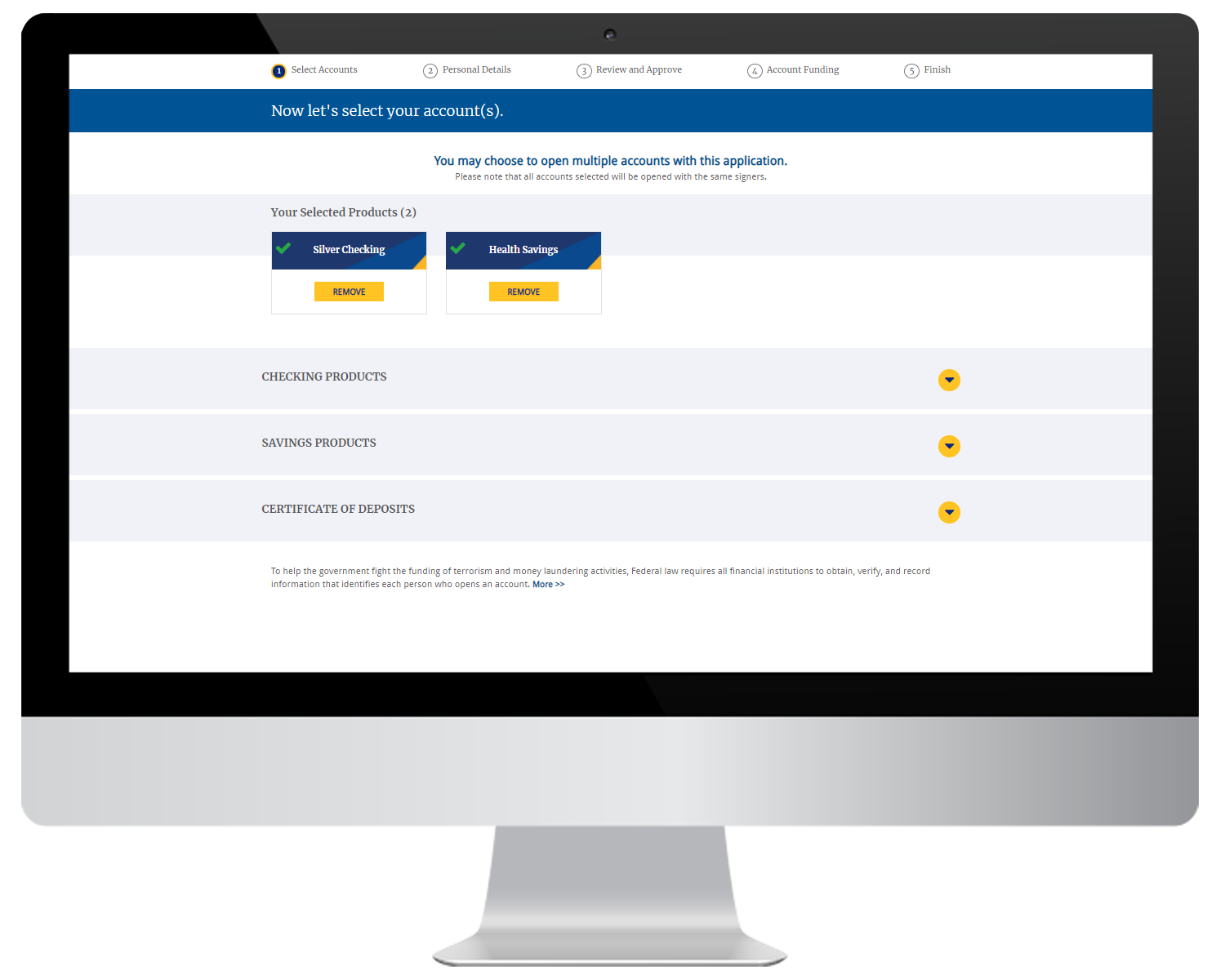

Unified Platform for All Banking Products

- Single platform to handle all products such as savings, checking, CD, MMA, IRA, HSA, etc.

- Ability to handle consumer and business accounts online.

Omni-channel and Personalized On-boarding Experience

- Omni-channel support for online, in-branch and customer care channels

- Options to start, save, and complete application across multiple devices.

Information Capture and Upload

- Pre-fill of data from ID documents or existing customer records

- Easy document and signature upload using a variety of devices

Customer Verification and Risk Management

- Third-party integration with IDV/IDA vendors for automated decisions

- Automatic risk assessment through integration with fraud check software, AML/BSA systems, OFAC databases, etc.

Activity Tracking and Monitoring

- Process insights including application volumes, channels, abandonment rates, completion times etc.

- 360-degree business activity monitoring for a holistic view of the customer lifecycle

Seamless Integration with Third-party Systems

- Tight integration into core banking systems for instant account opening

- Integration with payment gateways and account aggregates for funding.

- Other integrations including online banking, CRM, IDV/IDA, eSign, card issuance, and check ordering

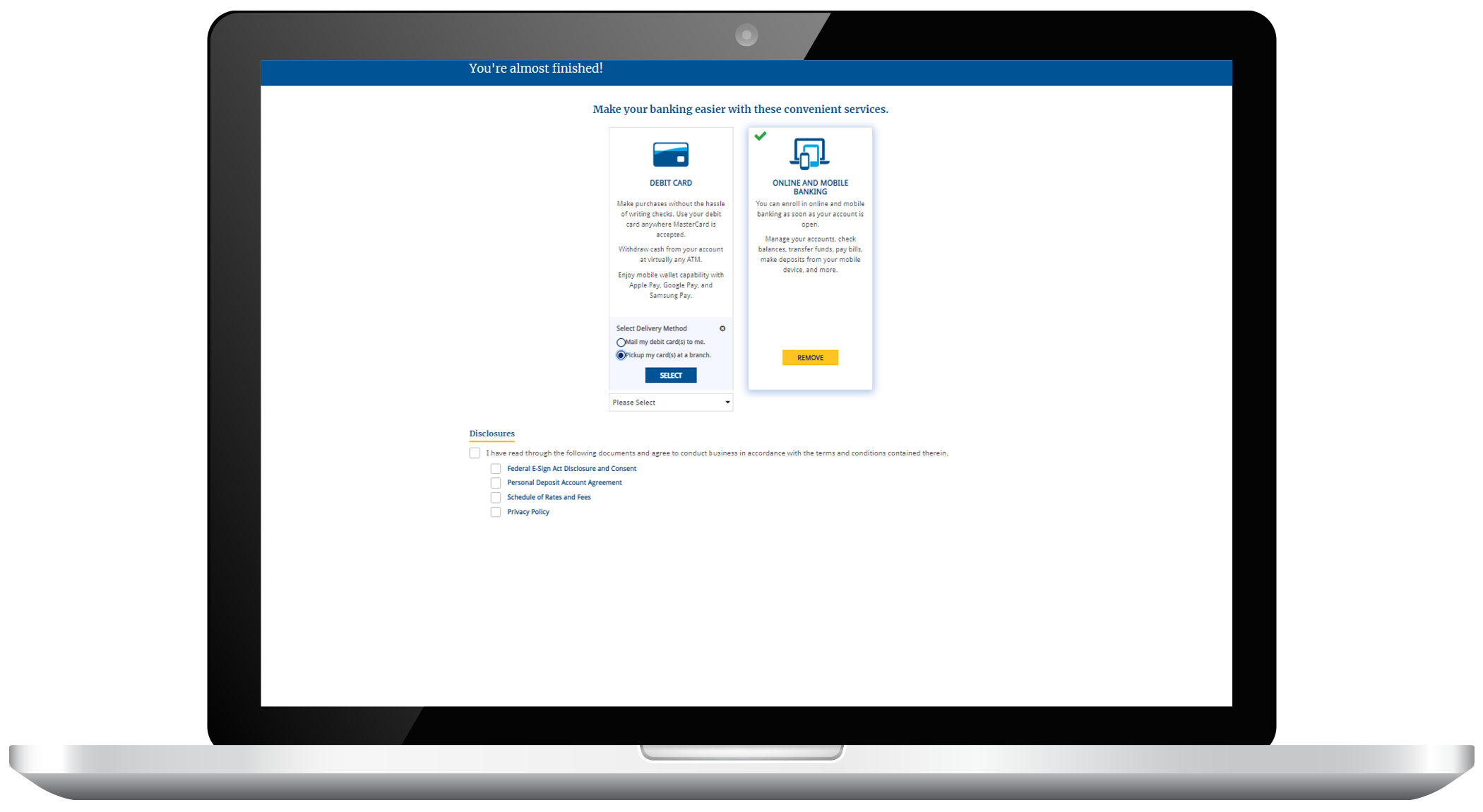

Customer On-boarding Activities

- Rule-based intelligent cross-selling and up-selling options

- Customer on-boarding activities including online banking enrollment and services setup

SUCCESS STORIES

Seamless Integration with Fintech Partners

Watch this video to understand how Advia Credit Union is leveraging Inviqa to seamlessly integrate with fintech partners and transform member experience.

Enhancing Account

Opening process

Learn how Georgia's Own Credit Union leverages Inviqa Account Origination Platform to minimize time taken to open an account, and easily integrate with third party systems.

Why Inviqa is the

Partner of Choice

Watch this video to learn why Inviqa is the partner of choice for Old Point National Bank.

Credit offers in

less than 1 minute

Qander Consumer Finance leverages Inviqa automation platform to transform and automate their banking processes, delivering credit offers to customers in under a minute.

50%

reduction in cost

Nancy foster, SVP and Credit Administrator, talks about using Inviqa solutiona to digitally transform BNB Bank's banking processes for improved customer experience.

Turnaround time reduced from day to an hour

Qander Consumer Finance leverages Inviqa automation platform to transform and automate their banking processes, delivering credit offers to customers in under a minute.

Accelerating digital across 20 branches

Learn how Wilson Bank & Trust is leveraging Inviqa Digital Transformation Platform for online account opening, business banking, and small business lending.

FREQUENTLY ASKED QUESTIONS

Yes, the Inviqa’s digital account opening solution provides a customer portal for the online initiation/application of a new deposit account. The online initiation is an extension of the financial institution’s website and is tightly integrated with the underlying account opening platform. The online initiation is configured as per the branding guidelines of the financial institution.

Inviqa online account opening software integrates with the following systems: Clickswitch, Deluxe, IDScan.net, Plaid, United Postal Service, Glia, Topaz Systems, Magiic Wrighter, IMMeSign, Experian, Finastra, Basys.

Typically, Inviqa has seen that once a consumer account is opened, the new customer is onboarded into the core. If the bank views onboarding activities as a separate process/requirement different from this, Inviqa would need a more detailed understanding of the bank’s consumer onboarding process. Inviqa will work with the bank during the implementation process to align the solution to the bank’s specific requirements regarding consumer onboarding.